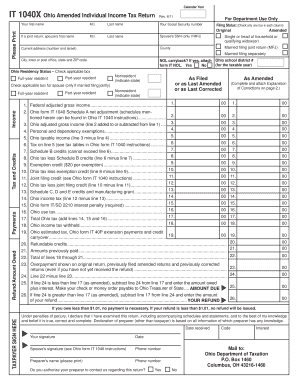

OH ODT IT 1040X 2014-2026 free printable template

Show details

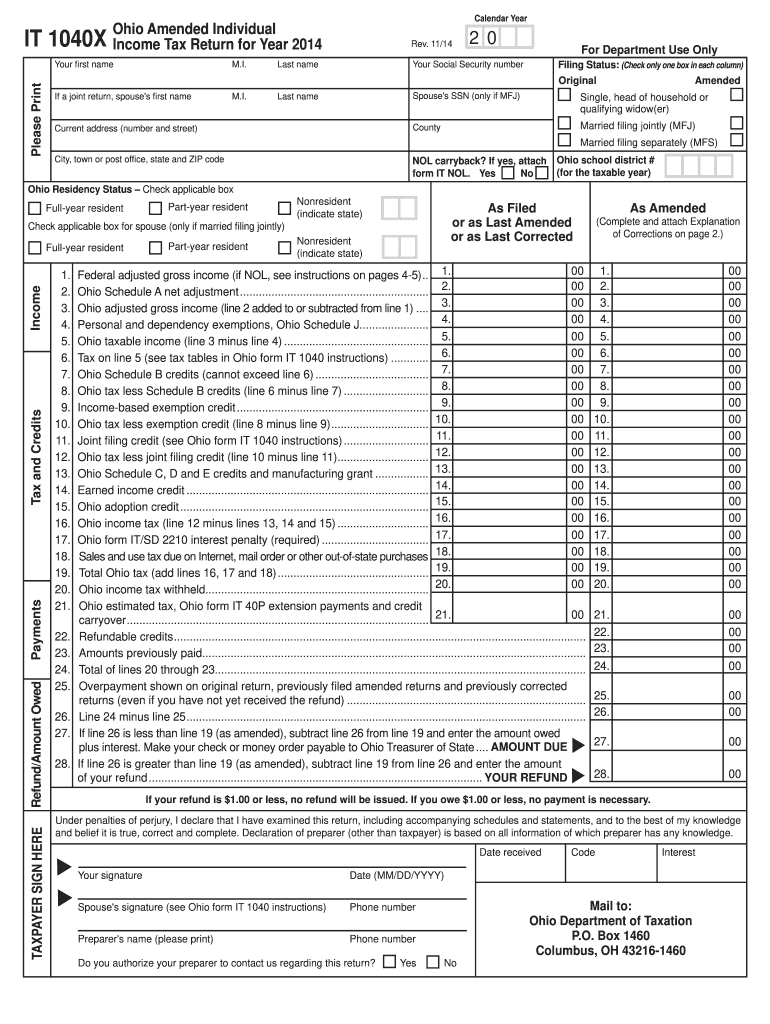

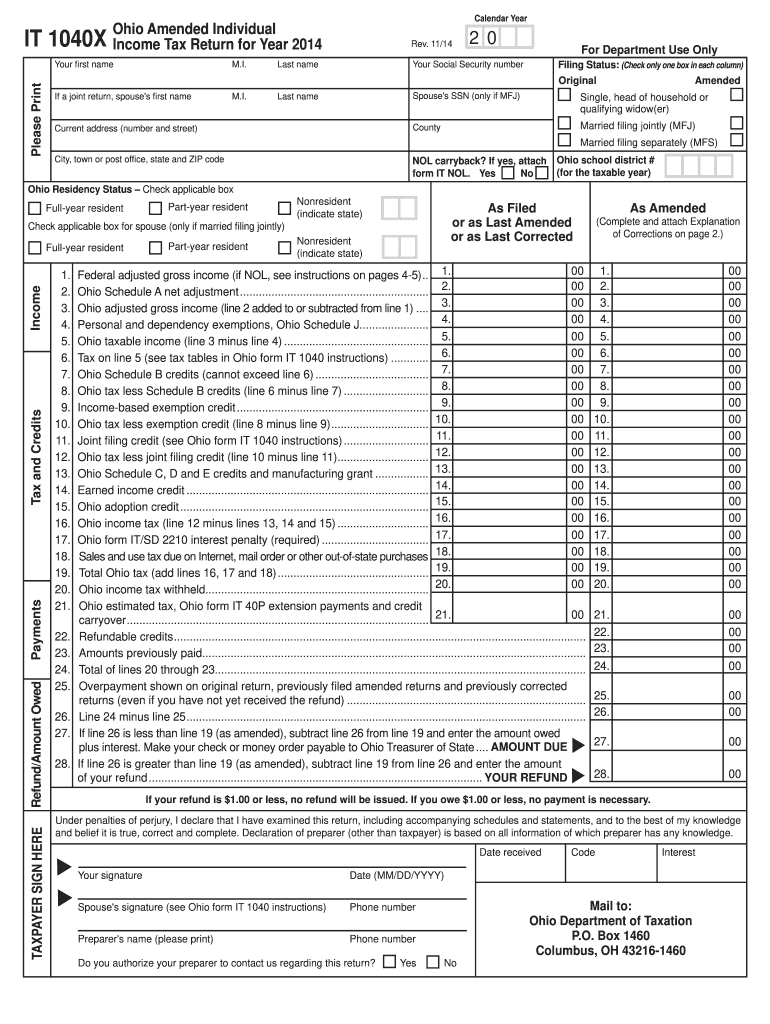

2. You can file Ohio form IT 1040X only after you have filed an Ohio the department s paperless or electronic tax return filing options. Please Print IT 1040X Calendar Year Ohio Amended Individual Income Tax Return for Year 2014 Rev. 11/14 For Department Use Only Filing Status Check only one box in each column Your first name M. O. Box 1460 Columbus OH 43216-1460. Phone 1-800-282-1780 -5- IT NOL IT NOL Net Operating Loss Carryback Worksheet If you are carrying back an NOL to more than one...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio it amended tax form

Edit your ohio amended return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is oh odt it ohio individual income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio amended tax return online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ohio amended form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH ODT IT 1040X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ohio state amended tax return form

How to fill out OH ODT IT 1040X

01

Gather all necessary tax documents, including W-2s, 1099s, and previous tax returns.

02

Obtain the OH ODT IT 1040X form from the Ohio Department of Taxation website.

03

Fill out your personal information at the top of the form, including your name, Social Security number, and address.

04

Indicate the tax year you are amending.

05

Complete the sections that need to be changed, providing accurate figures for the corrected amounts.

06

Attach any supporting documents that explain the changes.

07

Review the form for accuracy.

08

Sign and date the form before submitting.

09

Mail the completed form to the appropriate address provided in the instructions.

Who needs OH ODT IT 1040X?

01

Anyone who has filed an Ohio individual income tax return and needs to make corrections or amendments to their tax return.

02

Taxpayers who have received correction notices or discovered errors after filing their original return.

Fill

ohio tax form 2025

: Try Risk Free

People Also Ask about ohio amended tax

Can you send an amended return electronically?

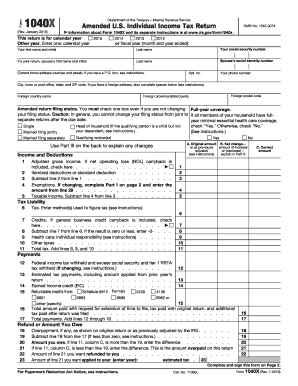

Can I file my amended return electronically? Yes. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Can I file an amended form 1040X electronically?

Can I file my amended return electronically? Yes. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

How do I file an amended tax return by email?

If you are amending more than one tax return, prepare a Form 1040X for each year's return and mail them to the IRS in separate envelopes. You will find the appropriate IRS address to mail your return to in the Form 1040X instructions.

How do I file an amended return electronically?

Amending Returns Electronically Select the period for which you want to submit an amended return for under "Recent Periods" tab. Select "File, Amend, or Print a Return" under the "I Want To" column. Select "Amend Return" under the "I Want To" column. Complete the online tax return with your amended figures.

What is form 1040X amended US individual income tax return?

The 1040-X, Amended U.S. Individual U.S. Income Tax Return is a form used by taxpayers who need to correct an error in a previously filed federal tax return. Common mistakes corrected with this form include errors in the taxpayer's filing status or number of dependents or omissions of credits or deductions.

Can I fill out a 1040X form online?

Can I file an amended Form 1040-X electronically? You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR.

Can I file an amended tax return on my own?

Can I file my amended return electronically? Yes. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

What is the easiest way to file an amended tax return?

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

How do I file an amended tax return myself?

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

How do I fill out an amended 1040X tax return?

On Form 1040-X, enter your income, deductions, and credits from your return as originally filed or as previously adjusted by either you or the IRS, the changes you are making, and the corrected amounts. Then, figure the tax on the corrected amount of taxable income and the amount you owe or your refund.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form it 1040x?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific where to mail ohio amended return and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the ohio tax exempt form 2025 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ohio tax exempt form example in seconds.

How do I edit ohio return amended edit on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share revise income tax return on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is OH ODT IT 1040X?

OH ODT IT 1040X is an amended individual income tax return form used in Ohio to correct errors on a previously filed Ohio individual income tax return.

Who is required to file OH ODT IT 1040X?

Any individual who has filed an Ohio individual income tax return (OH ODT IT 1040) and needs to make amendments to that return due to errors or changes in income, deductions, or tax credits must file OH ODT IT 1040X.

How to fill out OH ODT IT 1040X?

To fill out OH ODT IT 1040X, start by providing your personal information, including your name, address, and Social Security number. Then, indicate the tax year you are amending. Enter the correct amounts for income, deductions, and credits on the appropriate lines. Finally, explain the reason for the amendments in the designated section and sign the form.

What is the purpose of OH ODT IT 1040X?

The purpose of OH ODT IT 1040X is to allow taxpayers to correct or amend their previously filed Ohio income tax returns to ensure accuracy and compliance with tax laws.

What information must be reported on OH ODT IT 1040X?

The information required on OH ODT IT 1040X includes your personal information, the tax year being amended, corrected amounts for total income, adjusted gross income, tax credits, and any documentation that supports your amendments.

Fill out your OH ODT IT 1040X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Amended Income Tax is not the form you're looking for?Search for another form here.

Keywords relevant to ohio state tax form 2025

Related to amend ohio tax return

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.